Positive register: functional specification

Overview

The Positive Register (Positiivne Register) is the data exchange system, through which creditors that are members of the register are able to share information about person’s credit obligations with consent of the person in question. The Positive Register allows a creditor to fulfill statutory requirements of responsible lending and to ensure a person’s ability to fulfill his or her debt obligations. Loan applicants will no longer have to collect documents from other creditors. Customer will also be better protected from the problems associated with making emotional decisions about loans and excessive debts.

Definitions

- Data – information about existing obligations of a private person that allows the Member to assess creditworthiness of the individual, as described in “Data composition” chapter.

- Data exchange system – the IT solution used by the Member to exchange the Data;

- Administrator of the data exchange system – AS Krediidiinfo;

- Codebtor – a private person together with whom the Applicant applies for credit and who is taken into account while making the Credit decision;

- Credit decision – the decision made by the Member with regard to concluding the Consumer credit contract with the Applicant;

- Borrower – a private person to whom the Member issues the credit based on the Consumer credit contract;

- Applicant – a private person who turns to the Member with the wish to conclude the Consumer credit contract and provides his/her Agreement for using the Data possessed by the Members;

- Guarantor – a person who assumes the obligation before the Member to be liable for performance of the Consumer credit contract obligations of the Applicant;

- Agreement – consent of the Applicant for providing the Member making the inquiry with the Data of the Members being the recipients of the inquiry;

- Member – an Estonian or foreign company that joins the Data exchange system and shares the Data about the Applicant with other Members;

- Consumer credit contract – the contract on the basis of which the Member issues the credit to the Applicant;

- Subject – a party to the contract;

- Consumer credit – the credit issued to the Applicant by the Member.

Commercial rules

- Users of the system are the Members.

- A Member must join X-tee.

- In order to register a Member in the Data exchange system the company registration code, the company’s name and the name of the country where the company operates shall be provided.

- The Member inputs the Data to the database of Krediidiinfo or provides Krediidiinfo with an IT-based option to obtain the Data from its database.

- The Member updates the Data by sending to Krediidiinfo all current Data.

- The Member updates the Data every 24 hours. Where the Data is available on paper – the Member updates the Data every 7 days.

- The Member only shares the Data of the Applicant with prior agreement of the Applicant.

- It should be possible to control the Agreement retroactively.

- The Agreement can be a simple one or can be digitally signed.

- An answer for the Data request does not reflect information about the Member.

- Composition of the answer to the Data request is described in in “Data composition” chapter.

- An answer with regard to sharing and updating the Data contains the error code and description (http://services.krediidiinfo.ee/wiki/index.php/X-tee_liides_KRI6).

- The Members share the Data of the composition with other Members.

- The list of the Members of the Data exchange system together with the date of joining is available on Krediidiinfo website.

Data composition

- Date of updating;

- Personal ID code;

- Role of the person within the scope of the contract;

- Contract number (number of the Consumer credit contract concluded between the Member and the Applicant);

- Type of consumer credit;

- Effective date of credit agreement – date of commencement of the Consumer credit contract;

- End date of credit – the date of repayment of the Consumer credit;

- Consumer credit sum – the maximum sum of the Consumer credit contract paid or payable to the Applicant;

- Currency – currency of the Consumer credit contract;

- Payment schedule – the sum and the date of the next or the closest three payments;

- Balance – the amount of the obligation of the consumer before the Member;

- Overdue balance – the sum of payments overdue for more than 7 days;

- Requests – dates of requests made with regard to the Data of the Applicant made during the past three years.

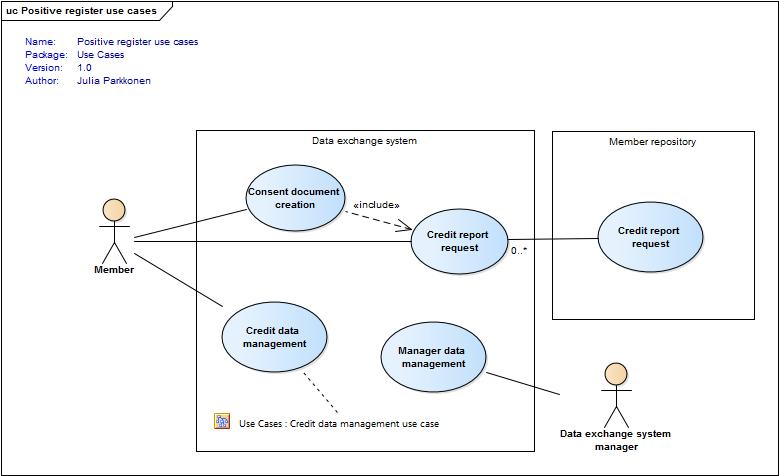

Use cases

Administration of the Members

Administrator of the data exchange system registers information about the Member in the Data exchange system / removes such information from the Data exchange system.

Sharing of the Data

The Member shares the data about the Applicant from the database of the Member through the Data exchange system.

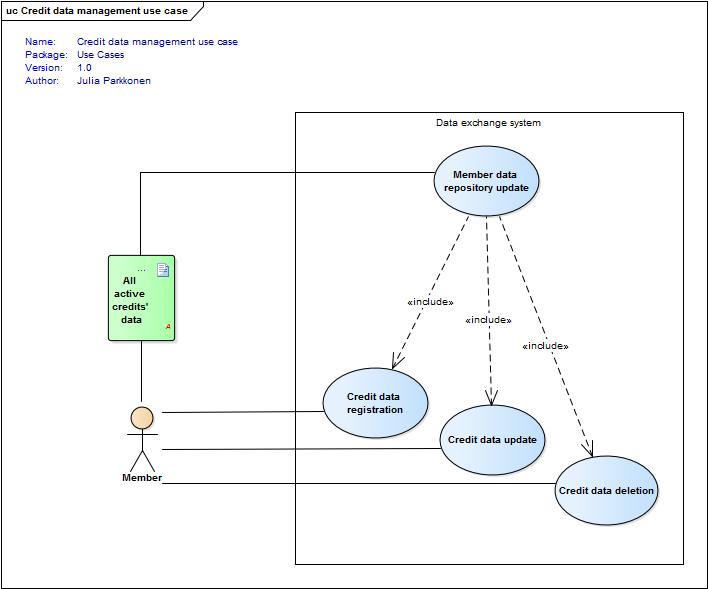

Administration of the Data

Prerequisite: The Member has concluded the authorization agreement with Krediidiinfo, under which the Member issues to Krediidiinfo the rights of authorized data processor with regard to the database held by the Member.

The Member forwards information from the database held by the Member to Krediidiinfo.

Scenarios

A) The Member forwards all current data on consumer credits to the administrator of the Data exchange system in XML format using x-road interface.

B) The Member changes the consumer credit details in the Data exchange system using x-road interface.

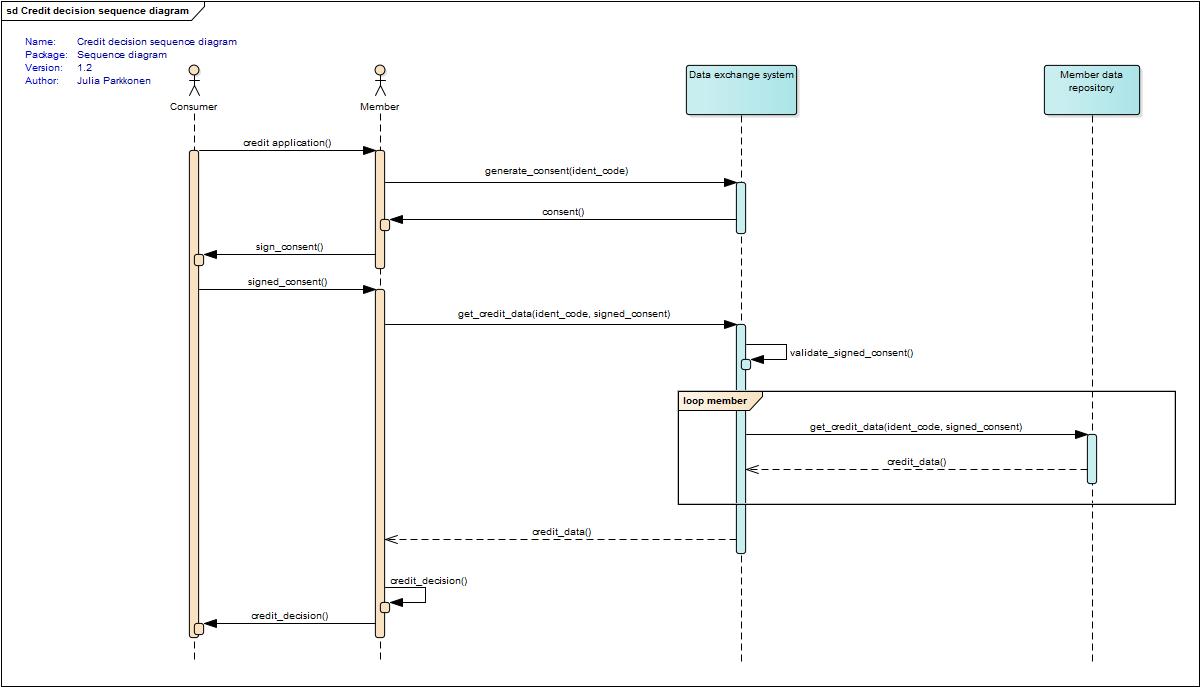

Sequence diagram